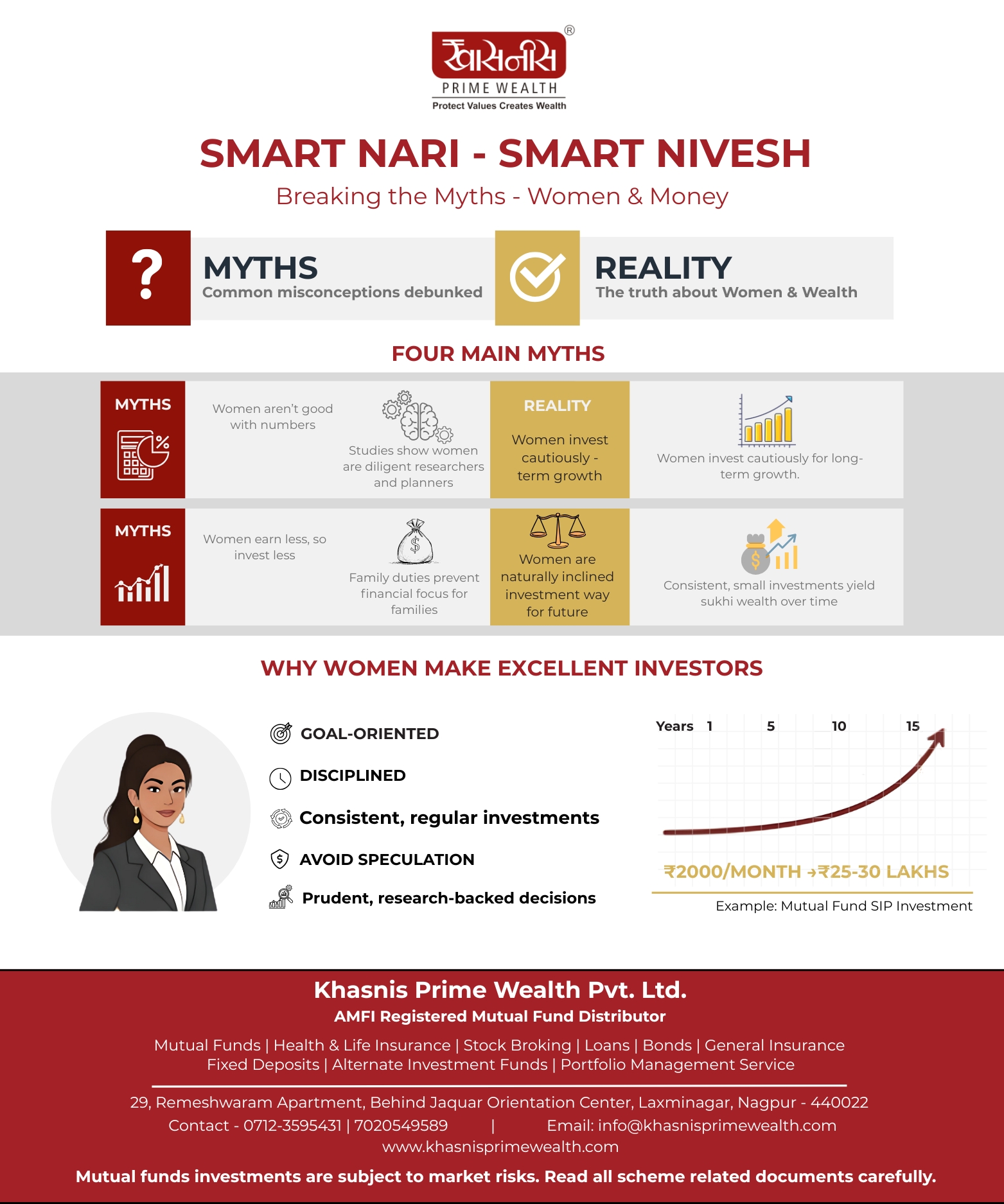

Breaking the Myths – Women & Money: Why Smart Nari Believes in Smart Nivesh

Breaking the Myths – Women & Money

When discussing finances, many women say, “It’s too complicated—my husband handles it,” or “I don’t earn enough to invest.” These aren’t mere excuses; they’re myths deeply embedded in society over generations. The Smart Nari – Smart Nivesh campaign is dedicated to shattering these misconceptions, proving that women are not only capable of managing money but often excel at it.

Myth 1: Finance is too complicated for women

Reality: Women already manage complex budgets more than men such as , household budgets, tuition fees, grocery bills, medical emergencies, and festive spending. If they can manage multiple tasks with limited resources, investing is just one more step forward. With simple tools like SIPs and goal-based investing, finance can be made easy and systematic.

Myth 2: I don’t earn enough to invest

Reality: You don’t need lakhs to start investing. The funda which you save from saving of house hold expenses are enough to invest. Even ₹500 per month in a mutual fund SIP can grow into lakhs over time. What matters is consistency, not size. Small beginnings often create big results.

Myth 3: My husband/father/brother will take care of it

Reality: Financial independence means not depending on anyone. Life is uncertain. Every woman should know how to manage her own finances, even if her loved ones are there for her. It’s about confidence and preparedness.

Myth 4: Investing is risky

Reality: Yes, investments involve some risk, but so does life itself. Like Recurring Deposits SIP Work’s. Risks can be reduced by diversifying into equity, debt, and gold. SIPs smoothen the ride by averaging costs over time. The biggest risk is not investing at all, because inflation eats away at savings.

Why Women Make Excellent Investors

Research worldwide shows women investors often do better than men. Why?

- Women are more disciplined.

- They avoid reckless speculation.

- They focus on goals, not just returns.

- They stick to the plan and don’t panic easily.

In short, women already have the natural traits of successful investors.

A Real-Life Example

Take the case of a working woman who started investing ₹2000 per month in an SIP at the age of 25. By 45, without doing anything extraordinary, she could build a corpus of over ₹25–30 lakhs. Imagine if she increases her SIP gradually with her salary increments—the numbers can grow into crores by retirement.

This isn’t magic. It’s simply the power of time and consistency.

Navaratri & Breaking Barriers

Navaratri celebrates the power of women—the destroyer of demons and the giver of wisdom. In the modern world, the “demon” many women face is financial dependency. By breaking myths, women can become stronger, wiser, and freer.

Key Takeaway

Money doesn’t need to be feared. It needs to be understood, respected, and managed. This Navaratri, let’s break the myths that hold women back and encourage them to say proudly:

“Yes, I can handle my money. Yes, I can build my future.”

Because a Smart Nari always believes in Smart Nivesh.

Recommended Posts

Why Women Must Take Charge of Their Financial Journey

September 10, 2025

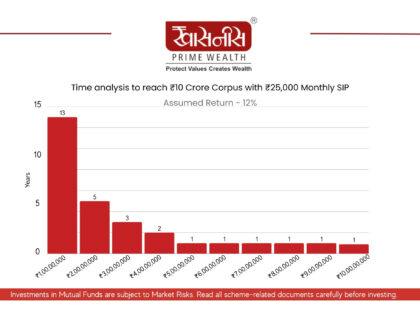

The First ₹1 Crore is the Hardest – But the Journey Thereafter Is Magical! By Khasnis Prime Wealth Pvt. Ltd.

March 29, 2025

The Role of a Mutual Fund Distributor: Why You Need One

March 12, 2025